The Inflation Reduction Act Is a Victory for Working People

On Sunday, the Senate passed the Inflation Reduction Act. There will be a House vote on this bill Friday, and it is expected to pass. Then it goes to President Biden for his signature. Once the process is completed, the legislation will represent a significant victory for working families.

About the act, AFL-CIO President Liz Shuler said:

The effects of this legislation will improve the lives of millions of Americans struggling to afford health care, seniors trying to pay for their prescriptions and future generations who will be able to see the impacts of drastically reduced carbon emissions.

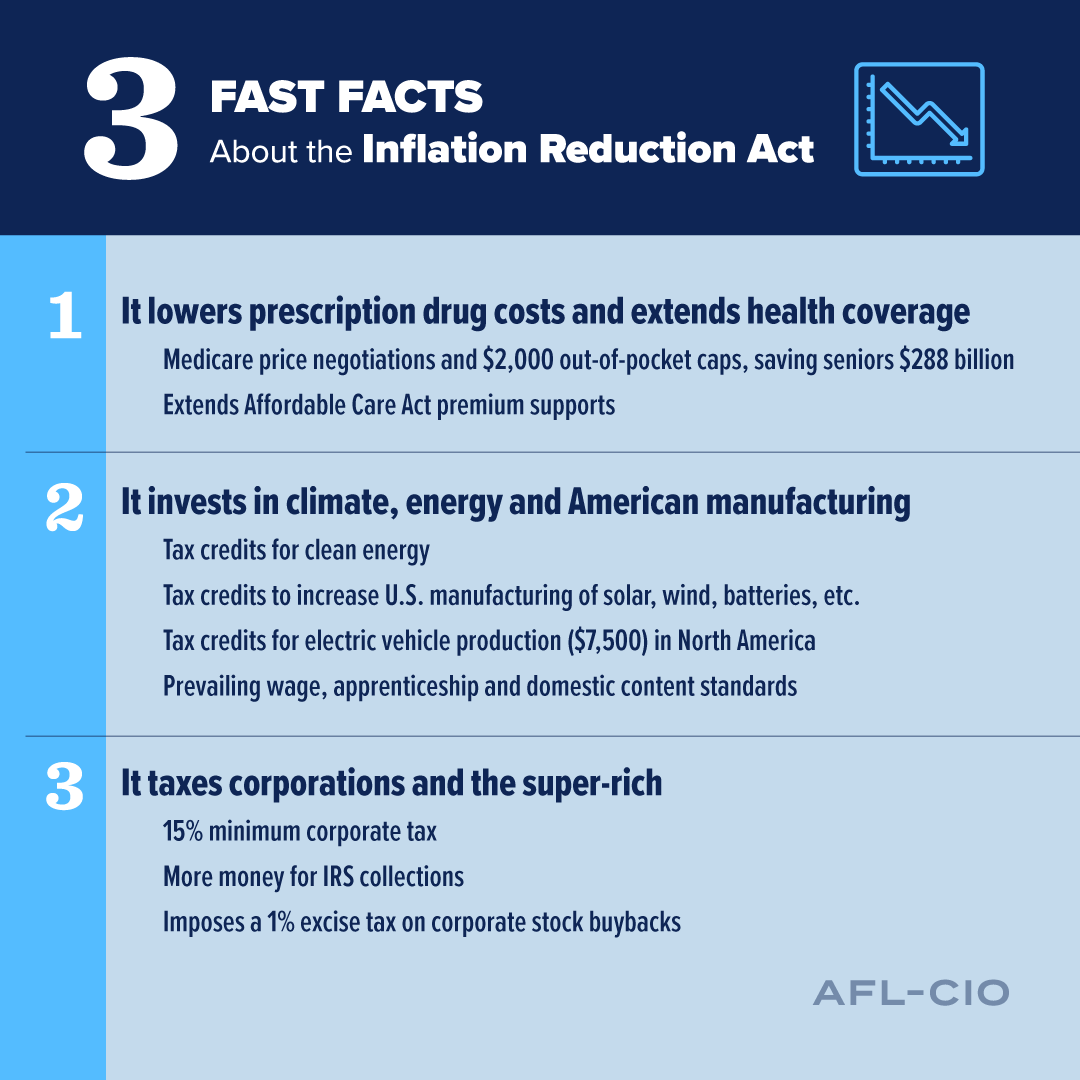

Specifically, the act will:

Allow for the negotiation of lower drug prices for seniors: Medicare will begin negotiating lower drug prices for seniors and people with disabilities. Drug price negotiation will focus on the highest expenditure drugs that have been on the market for nine to 13 years. Negotiation also will save the Medicare program $99 billion, which will bolster the program financially.

Create inflation caps for Medicare prescription drugs: The bill caps increases in prescription drug prices for Medicare recipients to the rate of inflation, putting a much-needed limit on how much manufacturers can raise costs for people who rely on prescriptions to manage their health.

Improve Medicare prescription benefits: Seniors’ out-of-pocket costs for prescription drugs covered by Medicare Part D will be capped at $2,000 a year, benefiting 1.4 million enrollees annually. In addition, cost sharing for vaccines will be reduced to $0. This cap will take an incredible weight off of the shoulders of older adults who are often living on a fixed income.

Prevent a premium spike for ACA enrollees: The bill prevents premium increases for 13 million people for the next three years by extending the enhanced premium tax credits for people with marketplace Affordable Care Act (ACA) coverage. The enhanced credits provided by the American Rescue Plan Act significantly reduce premiums for marketplace enrollees with low and middle incomes and cap premiums at 8.5% of income for all enrollees; without this new bill, the policy will expire at the end of 2022.

Invest $80 billion in IRS to strengthen enforcement: This is expected to increase collections by $203 billion and will not increase taxes on those with taxable incomes below $400,000.

Impose a 15% minimum corporate tax on corporations with profits exceeding $1 billion: This is expected to raise $222 billion.

Reduce climate pollution by 40%: Keeping President Biden’s promise to make the United States a global leader in the fight against climate change. These incentives will spur the economic transformation we need to address the climate crisis, make clean energy more accessible and affordable, and direct investments to underserved communities.

Provide tens of billions in energy investment and production tax credits for a wide range of clean sources of energy and energy storage, with strong wage and apprenticeship conditions and new domestic content incentives that can reshape clean energy deployment.

Include tens of billions in manufacturing tax credits to grow U.S. manufacturing of solar, wind, battery components and critical minerals production, and investments to retool and expand manufacturing plants to build clean energy and vehicles, and to upgrade and transform industrial facilities.

Support electric vehicle purchases by the postal service, and other major government investments to create domestic markets for made-in-America clean products.

Make major investments in communities and environmental justice, including innovative transportation investments, while additional provisions encourage clean energy and manufacturing reinvestment in energy and automotive, communities where jobs have been lost, and in disadvantaged communities.

Fund the Department of Energy to make hundreds of billions of dollars of loans to upgrade energy and grid infrastructure and to support innovative energy technology projects.

Enact clean energy tax incentives with prevailing wage, apprenticeship, and domestic content requirements that will create good-paying jobs in construction and manufacturing right here in the United States.

Create jobs and economic growth concentrated in clean energy. Analysis by AFL-CIO’s Labor Energy Partnership found the bill will add nearly 1.5 million jobs, and increase per capita personal income by nearly $4,000, all while transforming our economy to meet the climate crisis.

Shuler added, “While this bill represents an incredible step forward, we know the fight for climate and economic justice is not over.”

Kenneth Quinnell

Wed, 08/10/2022 – 10:45